student loan debt relief tax credit application for maryland resident

This application and the related instructions are for Maryland. The application can be downloaded by going to wwwmhecmarylandgov and.

We Solve Tax Problems Tax Debt Irs Taxes Debt Relief Programs

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents.

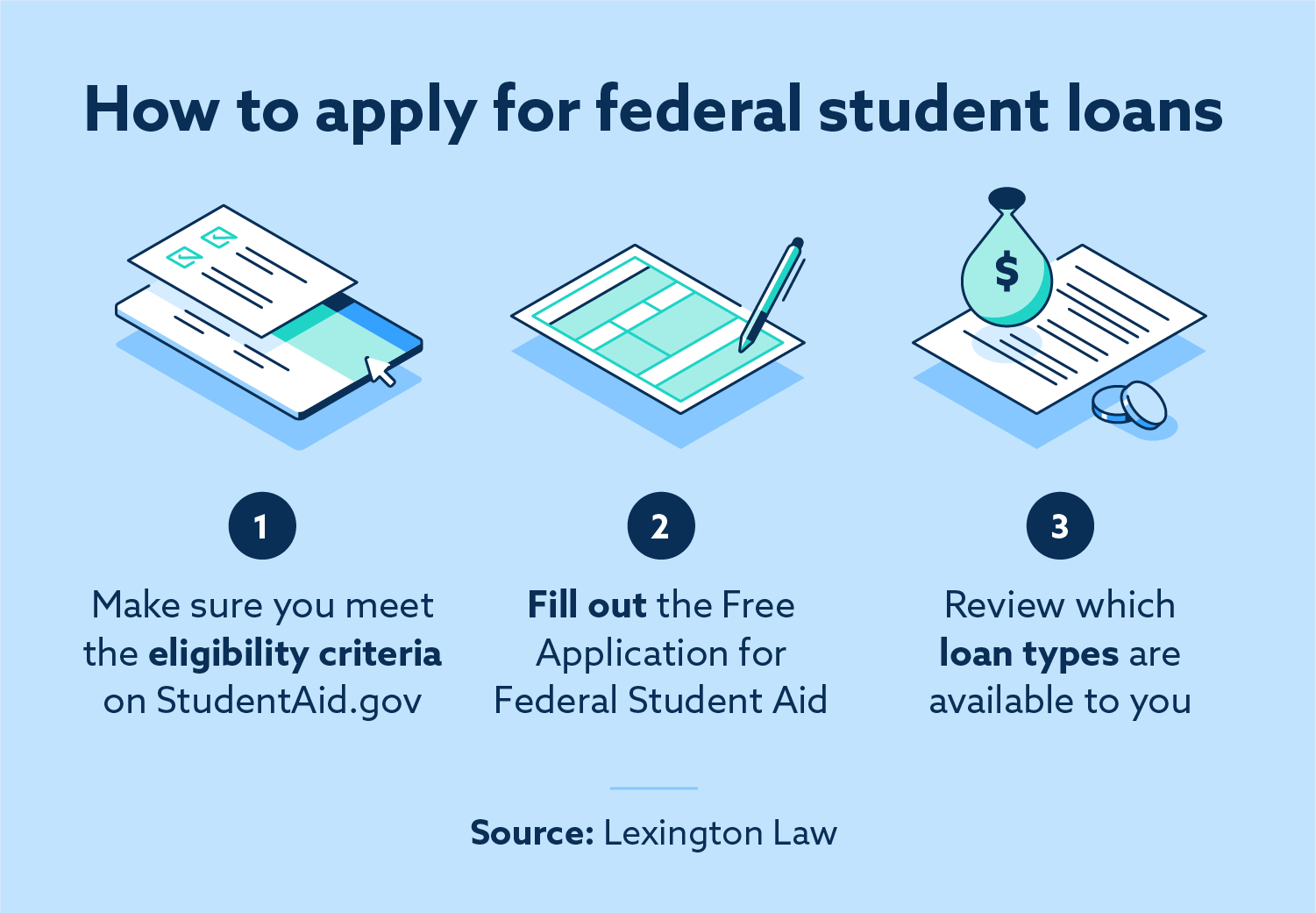

. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. September 9 2019 - 704 am. Instructions are at the end of this application.

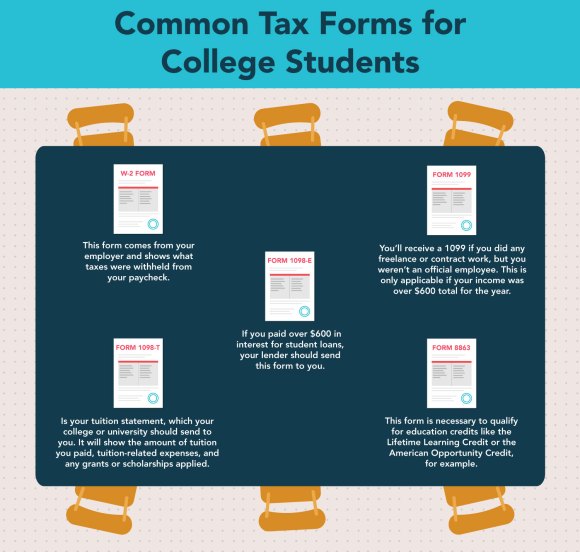

It was founded in. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. If you need assistance with your student loan servicer contact the Student Loan Ombudsman in our Office by email at studentloanombudsmanmarylandgov or by phone at.

Applications are now being accepted for the 2019 Maryland Student Loan Debt Relief Tax Credit. Maryland residents who have significant student loan debt may benefit from a Maryland tax credit. Have at least 5000 in outstanding student loan debt remaining when applying for the tax credit.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. ANNAPOLIS MD Governor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan debt awarded by the.

Your complete official transcript from each undergraduate institution that. View tax creditpdf from BIOL 101 at University of Maryland University College. Maryland offers the student loan debt relief tax Credit to Maryland residents who have incurred at least 20000 in student loan debt for college or graduate school.

Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. The Deadline for the Student Loan Debt Relief Tax Credit is September 15. Last year MHEC awarded 9484 Maryland residents the Student Loan Debt Relief Tax Credit with 5238 applicants who attended an in-state institution receiving 1000 each in.

This application and the related instructions are for Maryland. The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents. Student Loan Tax Credit Application.

If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Student Loan Debt Relief Tax Credit Application For Maryland Resident By Baby Shower September 07 2021 You can claim the student loan debt relief tax credit if you meet.

Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least. Complete the Maryland Student Loan Debt Relief Tax Credit Application as instructedbelow. The following documents must be included with your completed Student Loan Debt Relief Tax Credit Application.

About the Company Income Limit On Student Loan Debt Relief Tax Credit Application Maryland. The following documents are required to beincluded with. About 9 million in tax credits will be available for more than 9000 Maryland residents with student loan debt Gov.

The deadline to apply is September 15th. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Will have maintained residency within the state of Maryland for the 2020 tax year Have.

Larry Hogan announced TuesdaySince its launch in. To date nearly 41 million in tax credits has been awarded to Maryland residents. Student Loan Debt Relief Tax Credit Application for Maryland Resident Part-year Resident Individuals Tax.

Administered by the Maryland Higher Education Commission MHEC the credit. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Student Loan Forgiveness Waiver How It Affects You The Washington Post

Usa Finance And Payments News Summary 4 May 2022 As Usa

How Much Federal Borrowers Owe In Each State Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt 47abc

Learn How The Student Loan Interest Deduction Works

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

News Release Comptroller Franchot Urges Marylanders To Apply For Tax Credit

Maryland Student Loan Forgiveness Programs

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Wdvm25 Dcw50 Washington Dc

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

Can You Get A Student Loan With Bad Credit Lexington Law

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Maryland Student Loan Forgiveness Programs Student Loan Planner

Alaska Student Loans Debt Statistics Student Loan Hero